PROVIDENT FUND (PF)

Provident Fund (PF)

Certainly, here's a step-by-step guide to Provident Fund (PF) registration and compliance, presented in a more structured and expert-like manner:

1. Determine Eligibility and Applicability:

- Begin by understanding the eligibility criteria for PF registration in your jurisdiction. This typically depends on factors such as the number of employees in your organization, the nature of your business, and local regulations.

2. Legal and Regulatory Research:

- Conduct a thorough review of the local labor laws and regulations related to PF. Consult with legal experts if needed to ensure a comprehensive understanding.

3. Prepare Documentation:

- Gather all the necessary documents, including your organization's registration documents, PAN, bank account details, and employee particulars.

4. Identify Relevant Authority:

- Determine the government department or authority responsible for PF administration in your region. It is usually the labor or employment department.

5. Online Portal Registration:

- Many countries provide online portals for PF registration. Register your organization on the official government portal to initiate the process.

6. Unique PF Code Allocation:

- After successful registration, you will be assigned a unique PF code or employer identification number. This code is essential for all future PF transactions.

7. Employee Enrollment:

- Collect comprehensive details of your employees, including their full names, Aadhar numbers, bank account information, and salary details.

8. Contribution Calculation:

- Calculate the PF contribution rates mandated by local laws for both employees and employers. Ensure that these rates are correctly applied.

9. Contribution Deposit:

- Deposit the PF contributions, comprising both the employee and employer contributions, into the designated PF account within the prescribed time frame, which is usually monthly.

10. Record Keeping and Maintenance:

- Maintain meticulous records of PF contributions, withdrawals, and all relevant documents. A robust record-keeping system is crucial for compliance and audits.

11. Legal Compliance:

- Continuously monitor changes in PF laws and regulations to ensure that your organization remains in compliance with all statutory requirements.

12. Periodic Reporting:

- File periodic returns, reports, and statements as stipulated by PF authorities. This includes monthly, quarterly, and annual submissions, and they must be submitted on time.

13. Employee Communication:

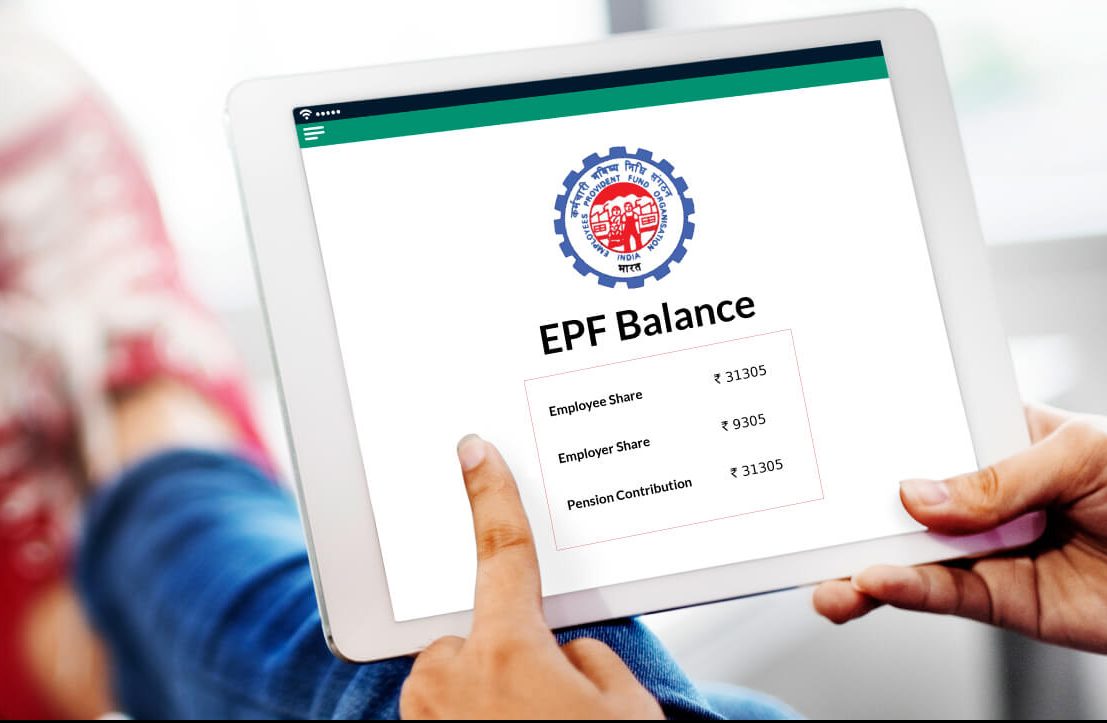

- Regularly update employees on their PF accounts, contributions made on their behalf, and ways to check their PF balance. Communicate any changes in PF rules and regulations effectively.

14. Audit and Inspection Preparation:

- Be prepared for inspections and audits conducted by government authorities. Ensure that all records are up-to-date and accessible for review.

15. Timely Updates:

- Immediately update PF records with any changes in employee details, such as new hires, resignations, or salary revisions.

16. Grievance Handling Mechanism:

- Establish a mechanism for employees to raise PF-related issues or concerns and respond to them promptly and professionally.

17. Legal Consultation:

- When in doubt or when facing complex PF compliance issues, seek advice from legal or financial experts with expertise in local labor laws and PF regulations.

Compliance with PF regulations is critical to avoid penalties and legal consequences. Maintaining a high level of expertise in PF matters, and staying updated with regulatory changes, is essential for long-term adherence to legal requirements. Government websites and agencies dedicated to PF administration can be valuable resources for guidance and information.